Maximize Returns with Real Estate Debt Investing

Invest in a Real Estate Debt Fund Designed for Stability, Income, and Growth. The Matador Note Fund offers accredited investors the opportunity to earn consistent, passive income through real estate-backed loans. Invest with confidence in a fund managed by experienced professionals and secured by real property.

Maximize Returns with Real Estate Debt Investing

Invest in a Real Estate Debt Fund Designed for Stability, Income, and Growth. The Matador Note Fund offers accredited investors the opportunity to earn consistent, passive income through real estate-backed loans. Invest with confidence in a fund managed by experienced professionals and secured by real property.

What is the Matador Note Fund?

The Matador Note Fund is a private equity debt fund pooling capital from accredited investors to provide short-term, real estate-secured loans. Targeting an annual return of 8-12%, it offers a stable investment alternative.

What is the Matador Note Fund?

The Matador Note Fund is a private equity debt fund pooling capital from accredited investors to provide short-term, real estate-secured loans. Targeting an annual return of 8-12%, it offers a stable investment alternative.

Why Invest in Real Estate Debt

with Matador Note Fund?

Why Invest in Real Estate Debt

with Matador Note Fund?

Passive Income

Receive consistent interest payments from real estate-backed loans, providing a steady source of passive income without the volatility of the stock market.

Risk Mitigation

Our loans are secured by real estate properties, reducing risk for investors. If a borrower defaults, the property serves as collateral, providing a safety net for your investment.

Attractive Returns

Earn competitive returns, typically between 8% and 12% annually. The Matador Note Fund offers higher yields than traditional fixed-income investments, with the added security of being backed by real assets.

Diversification

Add real estate debt to your portfolio for enhanced diversification. Real estate debt investments have a low correlation with other asset classes, making them an ideal hedge against market volatility.

Passive Income

Receive consistent interest payments from real estate-backed loans, providing a steady source of passive income without the volatility of the stock market.

Risk Mitigation

Our loans are secured by real estate properties, reducing risk for investors. If a borrower defaults, the property serves as collateral, providing a safety net for your investment.

Attractive Returns

Earn competitive returns, typically between 8% and 12% annually. The Matador Note Fund offers higher yields than traditional fixed-income investments, with the added security of being backed by real assets.

Diversification

Add real estate debt to your portfolio for enhanced diversification. Real estate debt investments have a low correlation with other asset classes, making them an ideal hedge against market volatility.

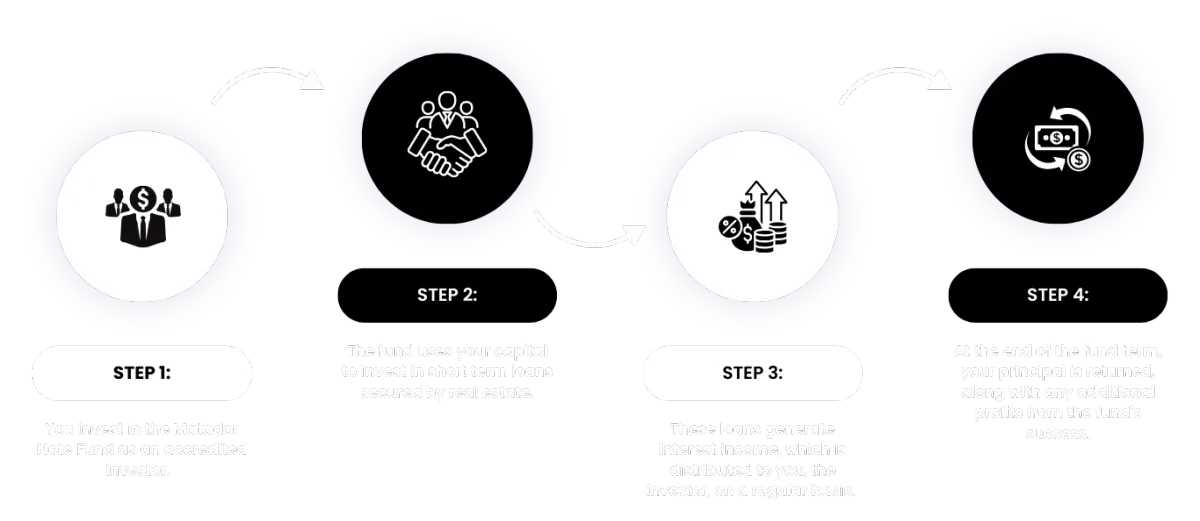

How It Works

How It Works

STEP 1

You invest in the Matador Note

Fund as an accredited investor.

STEP 2

The fund uses your capital,

alongside leverage from a credit facility,

to issue loans secured by real estate.

STEP 3

These loans generate interest

income, which is distributed to you,

the investor, on a regular basis.

STEP 4

At the end of the fund term,

your principal is returned, along with any additional profits from the fund's success.

Key Benefits for Investors

Leverage to Maximize Returns

By utilizing a credit facility, the Matador Note Fund can borrow capital at 9% and lend it out at 12%. This 80% loan-to-value (LTV) leverage allows the fund to magnify returns while maintaining prudent risk management practices.

Example: A $100,000 investment in the fund, with the fund utilizing its credit facility, can yield an annual return of approximately 20.8%, based on historical performance metrics.

Secured by Real Estate

All loans issued by the Matador Note Fund are secured by real estate assets. If a borrower defaults, the fund can foreclose on the property to recover its capital. This collateralization helps mitigate risk and protect investor capital.

Tailored for Accredited Investors

As an accredited investor, you can benefit from a professionally managed fund that prioritizes transparency, risk management, and competitive returns. Whether you're looking to diversify your portfolio or seeking a steady stream of passive income, the Matador Note Fund is designed with your needs in mind.

Key Benefits for Investors

Leverage to Maximize Returns

By utilizing a credit facility, the Matador Note Fund can borrow capital at 9% and lend it out at 12%. This 80% loan-to-value (LTV) leverage allows the fund to magnify returns while maintaining prudent risk management practices.

Example: A $100,000 investment in the fund, with the fund utilizing its credit facility, can yield an annual return of approximately 20.8%, based on historical performance metrics.

Secured by Real Estate

All loans issued by the Matador Note Fund are secured by real estate assets. If a borrower defaults, the fund can foreclose on the property to recover its capital. This collateralization helps mitigate risk and protect investor capital.

Tailored for

Accredited Investors

As an accredited investor, you can benefit from a professionally managed fund that prioritizes transparency, risk management, and competitive returns. Whether you're looking to diversify your portfolio or seeking a steady stream of passive income, the Matador Note Fund is designed with your needs in mind.

Who Should Invest in the

Matador Note Fund?

Passive

Income Seekers

If you're looking for stable, hands-off investments that generate regular income, the Matador Note Fund is an ideal solution.

Real Estate

Investors

Diversify your portfolio with real estate debt, a secure and reliable asset class.

Retirement

Investors

Supplement your retirement income with consistent, higher-than-average returns, backed by tangible real estate assets.

Private Lending Enthusiasts

Learn how private real estate lending works and how you can benefit from it without direct involvement in managing properties.

Who Should Invest in the Matador Note Fund?

Passive

Income Seekers

If you're looking for stable, hands-off investments that generate regular income, the Matador Note Fund is an ideal solution.

Real Estate

Investors

Diversify your portfolio with real estate debt, a secure and reliable asset class.

Retirement

Investors

Supplement your retirement income with consistent, higher-than-average returns, backed by tangible real estate assets.

Private Lending Enthusiasts

Learn how private real estate lending works and how you can benefit from it without direct involvement in managing properties.

FAQs

What is the minimum investment?

The minimum investment amount for the Matador Note Fund is $50,000. This allows us to maintain a diversified portfolio of high-quality loans while maximizing returns for our investors.

What is the expected return?

The fund targets an annual return of 8% to 12%, with the potential for enhanced returns through leverage. Investors can expect both regular income distributions and capital appreciation over the life of the fund.

How long is the investment term?

The Matador Note Fund typically has a 5-year term. However, there may be opportunities for early redemption, depending on the fund's liquidity and market conditions.

Who can invest?

The Matador Note Fund is open to accredited investors as defined by the U.S. Securities and Exchange Commission (SEC). If you meet the criteria for accredited investor status, you are eligible to participate.

FAQs

What is the minimum investment?

The minimum investment amount for the Matador Note Fund is $50,000. This allows us to maintain a diversified portfolio of high-quality loans while maximizing returns for our investors.

What is the expected return?

The fund targets an annual return of 8% to 12%, with the potential for enhanced returns through leverage. Investors can expect both regular income distributions and capital appreciation over the life of the fund.

How long is the investment term?

The Matador Note Fund typically has a 5-year term. However, there may be opportunities for early redemption, depending on the fund's liquidity and market conditions.

Who can invest?

The Matador Note Fund is open to accredited investors as defined by the U.S. Securities and Exchange Commission (SEC). If you meet the criteria for accredited investor status, you are eligible to participate.

Ready to Invest in Your

Financial Future?

Take the next step in securing passive income through real estate debt investments. With attractive returns, risk mitigation through real estate collateral, and professional management, the Matador Note Fund is designed to help accredited investors achieve their financial goals.

Ready to Invest in Your

Financial Future?

Take the next step in securing passive income through real estate debt investments. With attractive returns, risk mitigation through real estate collateral, and professional management, the Matador Note Fund is designed to help accredited investors achieve their financial goals.

Why Choose Matador Lending?

At Matador Lending, we have a proven track record of managing real estate debt funds that deliver consistent, attractive returns. Our team brings decades of experience in real estate, finance, and private lending, ensuring that your investment is in expert hands.

Why Choose

Matador Lending?

At Matador Lending, we have a proven track record of managing real estate debt funds that deliver consistent, attractive returns. Our team brings decades of experience in real estate, finance, and private lending, ensuring that your investment is in expert hands.

Contact Us Today!

We’re here to answer your questions and provide more information on how the Matador Note Fund can fit into your investment strategy.

Contact Us Today!

We’re here to answer your questions and provide more information on how the Matador Note Fund can fit into your investment strategy.

Contact us today!

(713) 366-4668

www.matadornotefund.com

Location: 5718 Westheimer Rd. Suite 1000 Houston, TX 77057

Contact us today!

www.matadorlending.com

(713) 366-4668

Location: 5718 Westheimer Rd. Suite 1000

Houston, TX 77057